Introduction :

In an increasingly competitive lending landscape, the need for efficient, streamlined processes has never been more critical. Our client embarked on a transformative journey to digitize the entire loan application process — from origination to underwriting, sales and operations — using a comprehensive Digital Customer Relationship Management (CRM) system. This innovative approach aimed to enhance the loan disbursal process through seamless integrations, leading to faster approvals and improved decision-making capabilities.

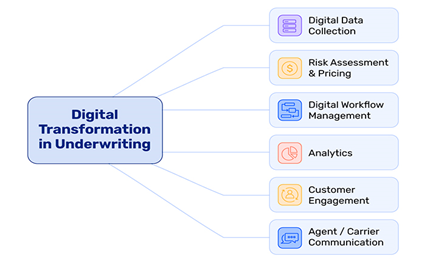

Digital Transformation Underwriting Key components

Before we dive into challenges, lets understand each key components of digital transformation in underwriting-

(Fig. 1 : Key components of digital underwriting)

1. Digital Data Collection: This refers to the collection of data from various sources, such as customer applications, external databases, and third-party providers.

2. Risk Assessment & Pricing: This involves using data analytics and predictive modelling to assess the risk associated with each applicant and determine appropriate pricing.

3. Digital Workflow Management: This refers to the use of technology to automate and streamline the underwriting workflow, reducing manual processes and improving efficiency.

4. Analytics: This involves using data analytics to gain insights into underwriting performance, identify trends, and make data-driven decisions.

5. Customer Engagement: This refers to the use of digital channels to engage with customers throughout the underwriting process, providing a seamless and efficient experience.

6. Agent/ Carrier Communication: This involves facilitating communication between agents, carriers, and other stakeholders to ensure smooth collaboration and information sharing.

Business Challenge:

The digitization initiative faced several challenges:

- Advanced Digital Capabilities : The existing loan origination process was manual and cumbersome, required the integration of advanced digital tools such as Know Your Customer (KYC), Income Verification, Banking Verification, Video KYC (VKYC), and eSign functionalities to automate and streamline operations.

- Simplifying File Management : Agents and Direct Sales Agents (DSAs) encountered difficulties in file login, tracking, and lead capture, hampered their productivity and efficiency in processing applications.

- Automating Credit and Operations : The traditional Credit and Operations processes were time-consuming, lead to longer turnaround times (TAT) that affected customer satisfaction and competitiveness.

Solution Implemented

To address these challenges, a robust Digital CRM solution was developed, incorporating the following key features:

- Integrated Digital Capabilities: The CRM included advanced functionalities such as Bureau checks, Digital KYC, Income and Bank Verification, and Income Assessment, complemented by Manual Verification processes. This integration enabled real-time validation of applicant information, significantly reducing manual errors and processing times.

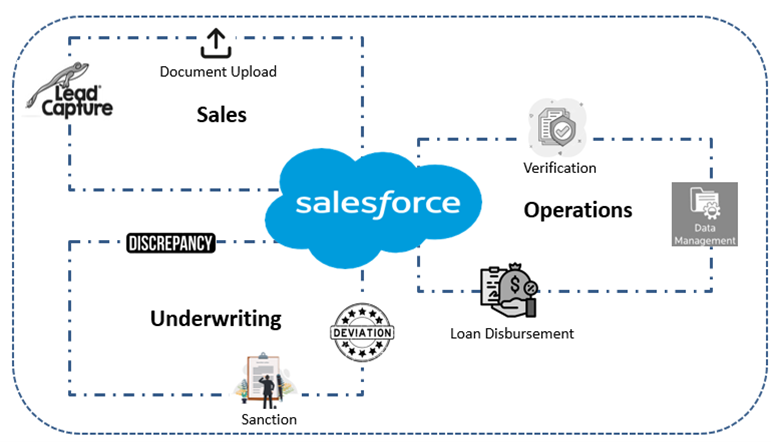

- Comprehensive Loan Application Processing: The Digital CRM empowered employees across Sales, Underwriting, and Operations teams by providing essential modules designed for every stage of the loan application lifecycle. Key modules included:

- Verification: Automated checks to ensure the authenticity of applicant data.

- Deviation Handling: Processes to manage exceptions and non-standard cases efficiently.

- Discrepancy Resolution: Tools to address inconsistencies in application data swiftly.

- Sanctioning Processes: Streamlined workflows for loan approval and sanctioning.

- Post-Decision (PD) and Decision Disposition (DDE): Modules to manage outcomes and communicate decisions to applicants effectively.

- Loan Servicing Features: The CRM also introduced a Loan Servicing component, including self-service (DIY) modules for customers to manage service requests independently, enhancing user experience and operational efficiency.

Fig. 2 shows the end-to-end loan application process after implementing salesforce.

(Fig.2 : End-to-End Loan Application Process)

Impact :

The implementation of the Digital CRM resulted in significant improvements across various operational metrics:

- Enhanced Efficiency: The automation of KYC, income verification, and other key processes drastically reduced manual intervention, enabled faster loan origination and approval times.

- Improved Decision-Making: With real-time data and advanced analytics capabilities, underwriters and sales teams could make informed decisions quickly, thereby reducing TAT and increasing customer satisfaction.

- Streamlined Operations: The Digital CRM's integrated approach simplified the file management and tracking processes, allowed agents and DSAs to focus on building relationships and closing loans rather than administrative tasks.

- Empowered Employees: The training and tools provided through the CRM ensured that staff across departments were well-equipped to manage the digital workflows, resulting in higher morale and productivity.

In conclusion, the Digital CRM for Lending Modules significantly transformed our client's loan processing capabilities, positioning them as a leader in the digital lending space. By embracing advanced technologies and streamlined processes, the organization not only enhanced its operational efficiency but also provided a superior experience to its customers.