Introduction

In the rapidly evolving fintech landscape, a leading finance company is committed to enhancing customer engagement while simultaneously reducing costs and streamlining the customer service experience. To achieve these objectives, the company partnered with Bajaj Technology Services to implement SalesBot, an AI-powered conversational chatbot designed to assist users in swiftly assessing their loan eligibility and addressing various inquiries. By leveraging cutting-edge generative AI technology, SalesBot delivers a seamless and user-friendly experience, empowering customers with essential financial insights and significantly improving overall service efficiency.

Business Challenge

Despite its strong market presence, company faced several critical challenges that hindered its ability to deliver exceptional customer service. The high volume of customer inquiries overwhelmed the support team, leading to prolonged response times and decreased customer satisfaction. Additionally, the complexity of financial products often left customers confused, resulting in missed opportunities for engagement and conversions. Furthermore, maintaining a cost-effective operation while striving to enhance customer experience proved difficult, as traditional service methods were not scalable. These challenges highlighted the need for a more efficient solution to streamline customer interactions and improve overall service delivery.

Solution

- SalesBot Overview: SalesBot is an AI-powered, conversational chatbot designed to assist users in addressing their inquiries and determining their loan eligibility. By leveraging cutting-edge generative AI technology, SalesBot engages in natural dialogues, effectively gathering the necessary user information to provide accurate loan eligibility assessments.

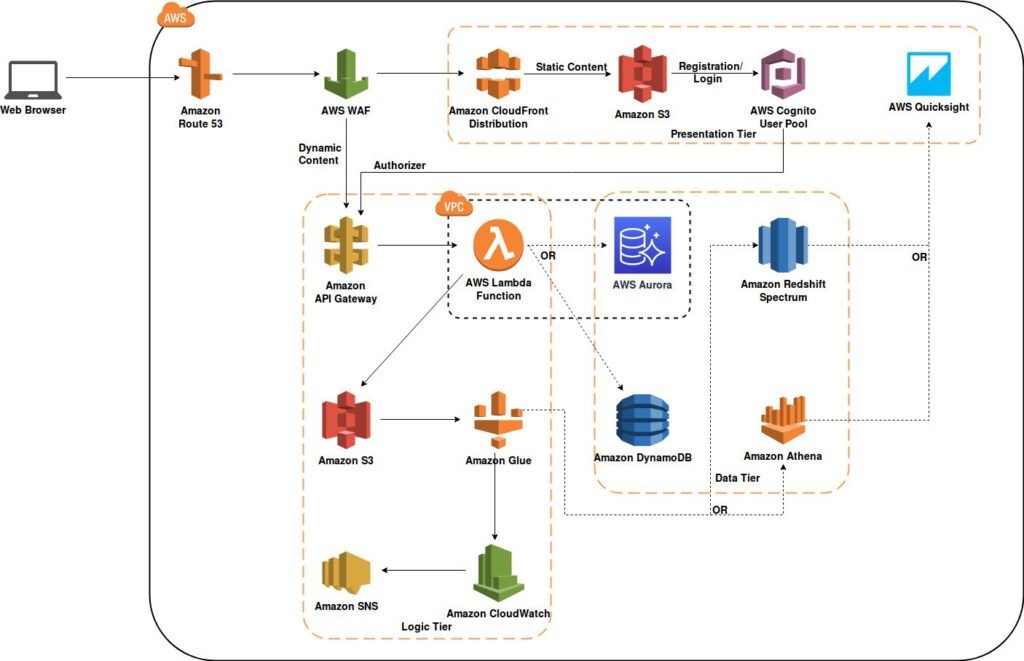

SalesBot operates under the Retrieval-Augmented Generation (RAG) framework, which combines retrieval mechanisms with generative capabilities. This architecture allows the chatbot to access a vast knowledge base, retrieving relevant information and generating contextually accurate responses in real-time. By utilizing this framework, SalesBot ensures that users receive precise and timely answers to their questions, enhancing the overall customer experience.

Key Features

- Rapid Eligibility Assessment: In under 2 minutes, SalesBot calculates and presents the user's loan eligibility, empowering them with crucial financial insights.

- Comprehensive Knowledge Base: Users can access an extensive repository of information about the loan process, addressing any doubtss or questions they may have.

- User-Friendly Experience: The integration of AI-driven conversational capabilities ensures a streamlined and personalized experience for users.

Technologies Used

- AWS Bedrock: For scalable AI services.

- LLM Model: Anthropic Haiku, providing advanced language processing capabilities.

- AWS Knowledge Base: Storing essential information and FAQs.

- AWS S3: For secure storage of data and documents.

- AWS SQS: Facilitating message queuing for efficient data processing.

- Python 3.12.2: The programming language used for developing the bot's functionalities.

Impact

The implementation of SalesBot has significantly transformed customer interactions. Key performance indicators reflect this positive change, with the average loan eligibility assessment time decreasing from 10 minutes to under 2 minutes, greatly enhancing efficiency. Additionally, the rate of inquiries resolved without human intervention soared to 85%, demonstrating the effectiveness of the chatbot in managing customer queries. User satisfaction also saw a substantial boost, increasing by 30% according to post-implementation surveys, as customers reported feeling more informed and empowered throughout the loan application process. Overall, SalesBot has not only streamlined service delivery but has also fostered a more engaging and responsive customer experience.