Introduction:

In today’s fast-paced financial landscape, efficiency and customer satisfaction are not just nice-to-haves—they’re essential for business survival and growth. Financial institutions, especially those in the loan origination space, face the complex challenge of balancing operational efficiency with customer experience while adhering to stringent compliance regulations. This case study reveals how our team implemented Salesforce Financial Services Cloud to solve these pressing issues, transforming a loan origination system (LOS) for a leading financial institution and yielding remarkable improvements across the board.

Business Challenge:

An NBFC was looking to streamline their loan application process and improve efficiency for both loan officers and borrowers. They implemented a LOS to automate document management, credit checks, and conditional approvals, significantly reducing processing time and increasing overall loan volume.

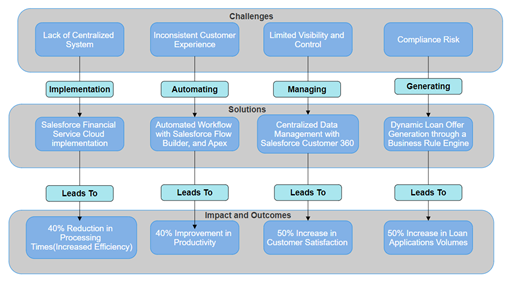

- Lack of a centralized system: This made tracking the progress of loan applications incredibly difficult. Without a unified view of each application, identifying bottlenecks or points of delay became a monumental task. Teams struggled to know where a loan stood at any given time, impacting both productivity and service delivery.

- Inconsistent customer experience: Disjointed workflows led to a fragmented experience for borrowers. Without a streamlined process, different departments handled various parts of the application, leading to confusion and frustration among customers who expected a faster and smoother experience.

- Limited visibility and control: With data siloed across various systems, the decision-makers lacked the insights needed to make informed business decisions. Without real-time data, it was impossible to identify emerging issues or opportunities for improvement, further hindering efficiency.

- Compliance risks: Regulatory compliance is a critical concern for any financial institution, but this becomes even more difficult when data is siloed. With information spread across disparate systems, ensuring compliance with constantly changing regulations became a challenge, increased the risk of non-compliance penalties.

These challenges were not only slowing down the loan origination process but were also leading to lost business opportunities and lower customer satisfaction rates. The institution needed a fast and comprehensive solution.

Solution:

Recognizing the multifaceted challenges faced by the institution, we crafted a tailored solution built on Salesforce Financial Services Cloud, designed to meet the specific needs of the loan origination process.

- Salesforce Financial Services Cloud Implementation: We started by implementing Salesforce Financial Services Cloud to centralize the entire loan application process. This gave borrowers a much more convenient and streamlined experience. With an easy-to-navigate interface, applicants could now complete their applications more quickly, potentially increasing completion rates and reducing the number of abandoned applications.

- Automated Workflows with Salesforce Flow Builder and Apex: To address the operational inefficiencies, we implemented configurable workflows using Salesforce Flow Builder. By automating routine tasks through Flow and Apex Triggers, we eliminated manual intervention in many parts of the process, speeding up approvals and increasing throughput.

- Centralized Data Management with Salesforce Customer 360: One of the key differentiators of our solution was the integration of Salesforce Customer 360, which brought together all customer-related data into a single, unified platform. With centralized data management, stakeholders could now easily access the information they needed, enabling faster and better decision-making.

Dynamic Loan Offer Generation: To further improve the efficiency of loan offers, we implemented a Business Rule Engine that dynamically generated loan offers based on real-time customer data. This allowed the institution to provide personalized loan options that better matched each borrower’s needs, leading to higher customer satisfaction and greater loan approval rates.

Fig.2 : A Data-Driven Approach to Modernizing Loan Processing

Impact

The results of this transformation speak for themselves:

- Increased Efficiency : 40% reduction in processing times due to automation.

- Improved Productivity : 40% increase due to faster decision-making and issue resolution.

- Higher Customer Satisfaction : 50% increase in loan application volumes due to improved borrower experience.

This comprehensive solution wasn’t just about fixing individual problems; it was about transforming the entire loan origination process into a seamless, efficient, and customer-centric experience.