Common Challenges in Online Insurance Purchase :

- Clarity and Visibility : The crucial details such as basic premium amounts are often buried or not highlighted prominently in the user interface.

- Plan Selection Complexity : Users find it challenging to navigate and choose the right insurance plan that suits their needs amidst multiple options.

- Transparency Issues : Concerns arise regarding the clarity and accuracy of the information presented during the purchasing journey.

- Confusing Add-ons : Similar-sounding add-on options can confuse users, leading to decision paralysis or incorrect selections.

- Complex Process : Lengthy and convoluted steps in the purchasing process discourage users from completing their transactions.

These issues aren't just inconveniences; they significantly contribute to a 40-50% drop in potential customers and revenue. Bajaj Allianz, for instance, faced a similar challenge where customers abandoned the process midway, necessitating intervention from sales call centers.

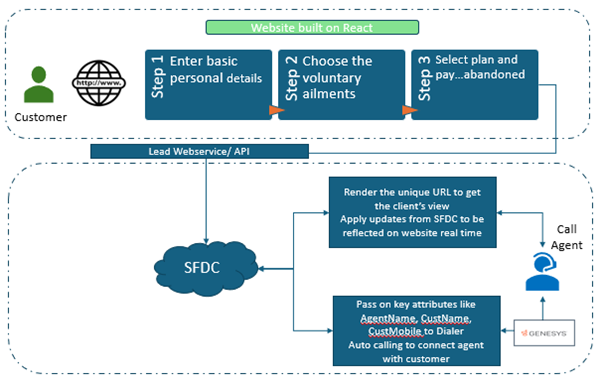

Solution - Integrating Customer Views and Call Center Operations:

To address these pain points effectively, a robust solution was devised leveraging Website and Salesforce integration:

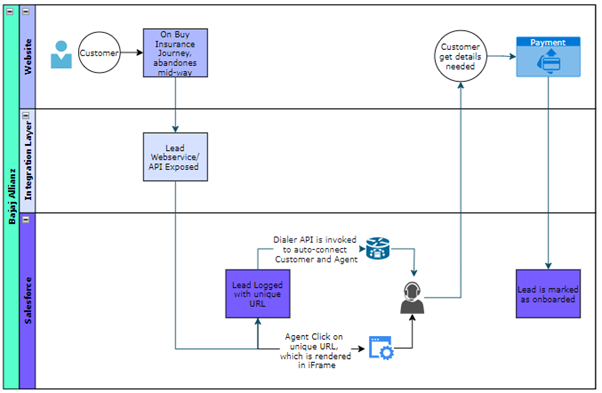

- Real-time Customer Insights : Which ensures that the call center has access to the customer's journey up to the point of abandonment.

- Seamless Process Continuation : When a customer abandons the journey, a lead record is logged along with a unique URL that preserves the exact state of the transaction.

- Data Synchronization : Salesforce CRM exposes APIs that allow real-time updates of customer details, and any input data captured during the online journey.

- Enhanced Customer Interaction : The integration also facilitates direct interaction via a telephony dialler (such as Genesys), which automatically connects the customer with the available agent. This seamless connection allows the agent to guide the customer through the remaining steps and clarify any doubts regarding the insurance plan.

High Level Solution Diagram:

Swimlane to depict seamless journey for customer, assisted by agent:

Benefits of Enhanced Online Insurance Purchase Experience

Insurers like Bajaj Allianz has gained significant benefits, here are the key advantages observed:

- Improved Brand Value and Trust : Bajaj Allianz has enhanced its online brand and fostered trust among customers, who appreciate the ability to seek clarification from human agents during their insurance purchase journey.

- Increased Customer Onboarding : The streamlined process has led to a notable increase in customer onboarding through digital channels.

- Enhanced Call Center Efficiency : Agents are equipped with all relevant customer details and can seamlessly continue interactions without the need for customers to repeat information. This efficiency reduces handling time and enhances overall customer satisfaction.

- Improved Customer Experience and NPS Score : The proactive approach to customer service has resulted in higher Net Promoter Scores (NPS) from customers. By providing personalized assistance and resolving queries effectively, Bajaj Allianz has reduced customer churn and increased satisfaction levels.

- Positive Reviews and Reputation Boost : The enhanced online experience and improved customer service have contributed to a significant increase in positive reviews for Bajaj Allianz.

Conclusion

By integrating advanced technology solutions with a customer-centric approach, Bajaj Allianz has not only minimized abandonment rates in online insurance purchases but also strengthened its position as a trusted insurance provider in the digital realm. The benefits observed—including increased customer onboarding, improved operational efficiency, higher NPS scores, and enhanced brand reputation—underscore the importance of prioritizing user experience and leveraging technology to meet evolving customer expectations.

As the digital landscape continues to evolve, such innovations will play a crucial role in shaping the future of insurance sales and customer service.

Ready to Transform Your Customer Experience?

Salesforce offers a robust platform that empowers insurance manufacturers and distributors to overcome technological challenges, deliver exceptional omnichannel experiences, and unlock operational efficiency. By harnessing the power of Salesforce, you can build stronger customer relationships, drive loyalty, and differentiate your brand in a competitive market.

Interested in learning more about how our team can help you leverage Salesforce to transform your customer experience? Contact us today at info@bajajtechnologyservices.com or visit us at www.bajajtechnologyservices.com to unlock the full potential of your insurance business.